Search Results

Found 228 Results

Onity Mortgage - FAQs

We are excited to announce that PHH Mortgage will be changing its name to Onity Mortgage.

Your mortgage servicer is not changing, and there is nothing you need to do right now related to our name change. We are the same company with a nearly 40-year legacy of serving homeowners, but now with a new name that is built with our customers in mind.

Frequently Asked Questions:

Is my mortgage account being transferred?

No, your mortgage is still being serviced by the same company. You will just see Onity Mortgage where you used to see the company name PHH Mortgage.

Will my account number or any other details about my account change?

No, your account number is not changing. Your mortgage is still being serviced by the same company. You will just see Onity Mortgage where you used to see PHH Mortgage.

Do I need to do anything due to your name change?

For some customers, we will provide a new website address and mobile app to utilize in the future. If this applies to you, we will send you details about the new website address and mobile app link to download.

Will my online or mobile app log in credentials change?

No, your username and password will not change and will not need to be updated due to our name change. However, you may need to review your spam filter as some of our email address updates may cause emails or web alerts to be inadvertently directed to spam folders.

Is PHH Mortgage going away completely?

No, PHH Mortgage is still the licensed mortgage entity for Onity Mortgage. You will still see PHH Mortgage in a limited way such as on your credit report.

I use my bank’s bill payer service. Do I need to update anything with my bank?

No, we will continue to accept payments to PHH Mortgage. However, please feel free to update your bill payer information to Onity Mortgage for ease of reference in the future.

I’m on Autopay, where you currently automatically draft my payment. Do I need to do anything?

No. No updates are needed if you make Autopay payments via our website.

I mail my monthly payment to you - do I need to do anything?

We will continue to accept checks made payable to PHH Mortgage. Please feel free to make your check payable to Onity Mortgage in the future though.

Will I see a different name on my credit reporting?

Yes, you will see both the PHH Mortgage & Onity Mortgage names on your credit report. For example: PHH Mortgage dba Onity Mortgage or PHH/ONITY

Terms & Conditions

How do I order a payoff quote?

Option 1: Online

Log in to your account on MortgageQuestions.com and click Payment at the top of the screen. In the "Loan Payoff" box, click View Payoff Quote. Click CONTINUE to submit the payoff quote request.

Option 2: In Writing

You can send us a written request for a payoff quote. Include the date you would like the quote to be good through. You can send the request by email to payoffs@mortgagefamily.com or by fax to 1-856-917-8283.

Option 3: By Phone

To request a payoff quote through our automated phone system or with one of our agents, call us at 1-800-449-8767.

Is there a fee to request a payoff quote?

Homeowners Insurance Tips

About Us

PHH Mortgage is a full-service mortgage company, helping customers for nearly 40 years. Our 5,000 employees are committed to delivering personalized mortgage service to help customers save money and build equity.

As a subsidiary of Onity Group Inc., a leading financial services company, our success is grounded on a shared set of

Company Values that guides our behavior and defines the way we do business.

We’re a servicing leader with a strong track record of success in foreclosure prevention and loss mitigation helping homeowners stay in their homes. We focus on working together with our customers to give a great customer experience.

Our Highlights |

||

|

||

|

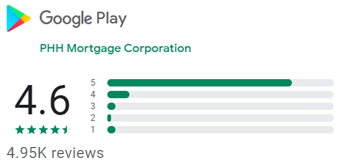

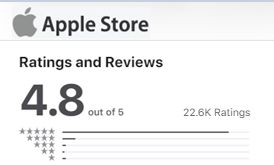

What Our Customers Are Saying |

||

|

|

|

|

Careers |

||

|

Want to find out what career positions we have available? Research our opportunities to |

What is Autopay?

Escrow Education Center

Escrow Education Center

.png)