Articles

Taxes and year-end

For customers receiving mailed statements, your year-end tax information will be included with your January billing statement and postmarked no later than January 31 (or the next business day). You should receive it within 7-10 days after mailing.

If you are enrolled in paperless, your year-end tax documents will be available in the Document Center on or before January 31. You'll receive an email notification once they're ready to view or download.

For more detailed information about the Form 1098, contact your tax advisor or refer to the IRS Tax Forms and Year-End Frequently Asked Questions.

If you are enrolled in paperless, your year-end tax documents will be available in the Document Center on or before January 31. You'll receive an email notification once they're ready to view or download.

For more detailed information about the Form 1098, contact your tax advisor or refer to the IRS Tax Forms and Year-End Frequently Asked Questions.

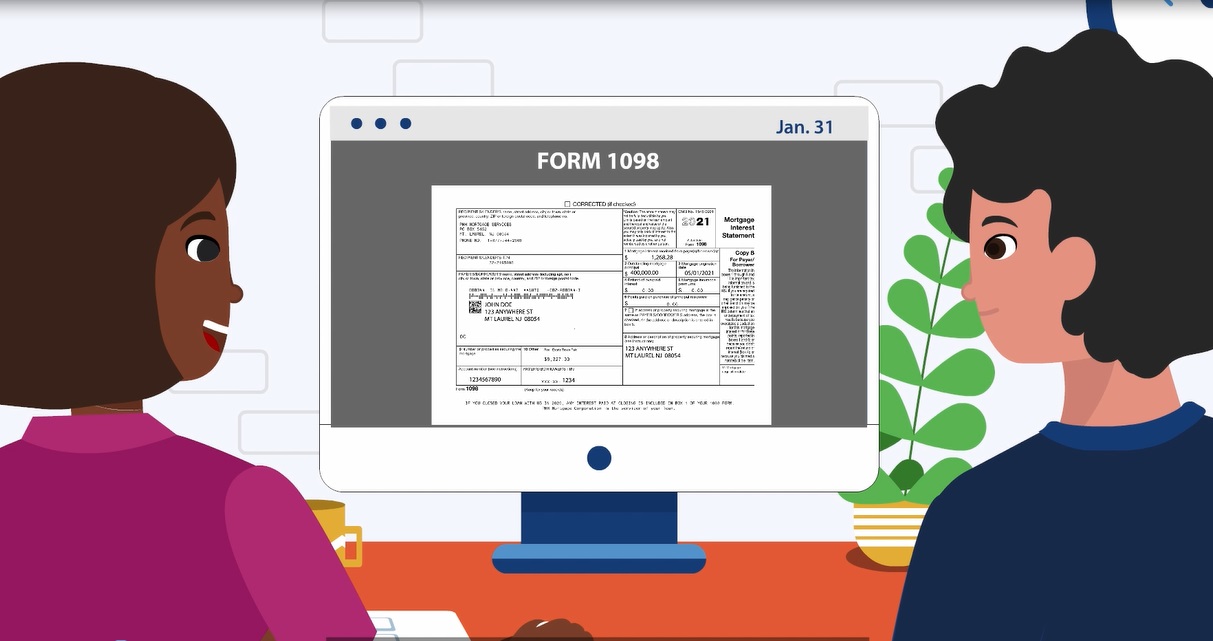

How to Read Your Form 1098

Watch a quick video to learn how to read your Form 1098.

Need Help? Contact your tax advisor or Contact Us.

Get Answers to Tax and Year-End

Frequently Asked Questions.

For a transcript of this video,

click here.

Escrow Education Center

Escrow Education Center