Need Help?

Call Us

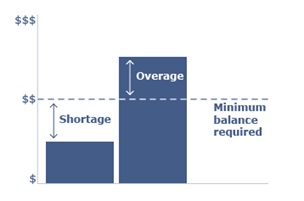

Escrow Shortage and Overage

We explain shortage and overage and how it’s determined.

What’s a shortage? A shortage is an outcome of your escrow analysis. When we review your escrow account, we look at what we’ve paid in the last 12 months and what we expect to pay in the upcoming 12 months. If your account is projected to have less

than the minimum required account balance, that means there isn’t enough money to cover your costs. That’s a shortage.

There are two ways to cover a shortage:

- You can pay in full if the shortage is less than one of your regular escrow payments.

- We’ll spread the amount out over a minimum of 12 months and include it in your monthly payment amount.

If you want to make any deposit to your escrow account, login to your account and click the Payment button at the top of the screen. To make a deposit by mail or phone, see other commonly asked questions.

What’s an overage? When we review your escrow account, we look at what we’ve paid in the last 12 months and what we expect to pay in the upcoming 12 months. If your account is projected to have more than the minimum required balance, there’s an overage. When there’s an overage, we’ll send a refund check if the surplus is greater than $50.00 and the account is current and not in bankruptcy at the time of analysis.

See other commonly asked questions for other information about an overage.

How is the required minimum balance calculated? Typically, unless your property’s state law or mortgage note says differently, the required minimum balance for an escrow account is the total of two months escrow payments for both taxes and

insurance.